Fair Taxes

All people and communities do better when everyone has the resources they need to prosper and thrive. Decisions about tax policy affect whether we have the resources to keep money flowing to families, towns, and our economy.

Taxes like the income tax, sales tax, and property tax are how we all pitch in to pay for those things that create a better quality of life for all of us: schools, housing, transportation, health care, clean air and water, parks, and family supports like food and child care assistance that make sure nobody gets left behind.

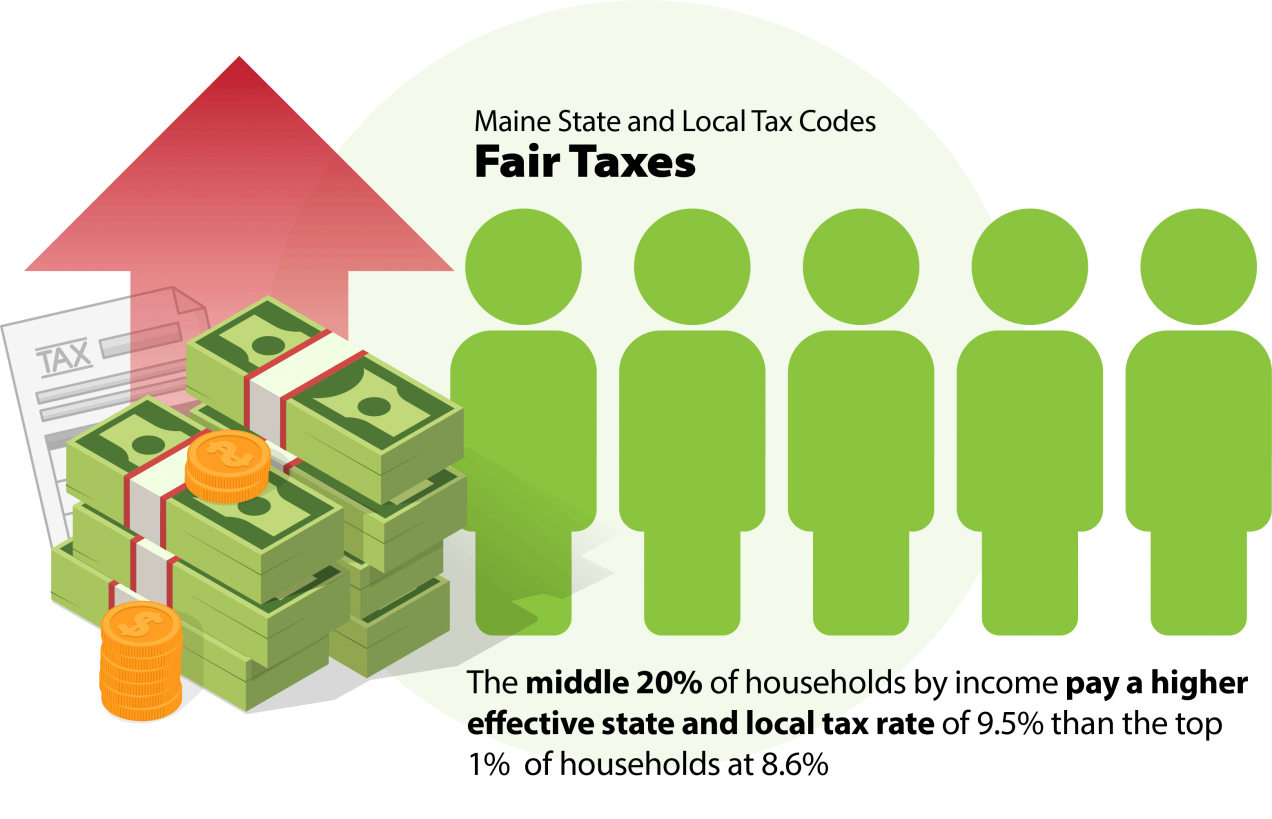

But today, our tax code is not built to ensure prosperity for all Mainers. Tax cuts that primarily benefit the wealthy have left the state consistently unable to adequately fund schools and communities, and left other priorities competing against each other for funding. Wasteful tax breaks have allowed profitable corporations to pay less than they should, reducing funding for services that benefit all of us.

The pandemic downturn has revealed the limitations of our inadequate, unequal tax code. Maine faces hundreds of millions in revenue shortfall over the next two-year budget, which could lead to economically damaging layoffs and cuts to services critical to Maine’s recovery.

While low- and moderate-income Mainers have been hit hard by the pandemic, wealthier Mainers are less likely to have gotten sick, less likely to lose their jobs, and more likely to have seen their wealth grow even during the unprecedented downturn.

Un-rigging our tax code will ensure all Mainers are paying their fair share, and will secure the resources necessary to fund Maine’s pandemic recovery.

As we work to repair our broken tax code, federal and state tax policies must adhere to five key principles:

- Fairness: Our tax system should ask those who benefit the most from our economy -- the wealthiest and profitable corporations -- to contribute their fair share.

- Adequacy: Our tax system should raise enough revenue to ensure every Maine community has the resources it needs to thrive.

- Equity: Our tax system should tear down barriers to racial and gender equity. Policy choices like weakening the estate tax, which primarily benefits white families who historically have been able to accumulate more wealth, should be reversed and tax benefits that fail to recognize unpaid care labor as work should be restructured to eliminate bias against women who are more likely to take on this work.

- Democracy: Our tax system should reflect our democratic values. Corporate lobbyists and the wealthy and well-connected shouldn’t have more power and voice in our policymaking than workers, families, and communities.

- Efficiency: Our tax system should be simple enough for everyone to understand and for government to enforce. An efficient tax code would prevent complex loopholes that corporations and the wealthy use to rig the tax code in their favor.

What you can do …

Taxes are how we come together to pay for the things that benefit all of us, like good schools, safe roads, clean water, and a safety net that keeps families from poverty when they face tough times.

But powerful special interests have manipulated our tax code with loopholes and tax breaks that let the wealthy and profitable corporations get out of paying what they should. Mainers for Tax Fairness is a coalition of organizations working to clean up our tax code and raise the revenue Maine needs to invest in strong communities. If your organization would like to join, email Ryan at ryan@mecep.org.

For more information and to take action, sign up for updates from MECEP Action.